There’s no Christmas in July for long supply chains that wind through China’s busiest ports. According to a recent article in ThomasNet, an on-line sourcing platform, a major outbreak of COVID-19 has led to slowdowns at major facilities in Guangdong province. This part of southern China is home to manufacturers who make and ship everything from printed circuit boards to retail products. Yantian, one of the country’s largest ports, was shuttered for three weeks, according to a BBC report.

Congestion at China’s ports remains a problem as rules surrounding health, safety, and cleaning continue to slow shipments from four of the largest Guangdong locations. There are new requirements for disinfecting surfaces as well as daily limits to the number of vessels that can dock and leave. This comes at a time when there is pent-up demand for manufactured goods, a shortage of raw materials, and too few shipping containers available in Asia.

When Risk Mitigation Fails

Ironically, the latest problems with long supply chains are caused in part by corporate strategies that are designed to minimize risk. In the West, the holiday season is still months away; however, many retailers placed orders with Chinese manufacturers this spring in order to receive shipments by fall. With so many orders now ready to ship, the COVID-related slowdowns at China’s ports come at what would have been an especially busy time. Companies that need industrial products are caught in this proverbial logjam.

Industry observers such as James Baker of Lloyd’s List, which tracks global shipping, aren’t predicting relief anytime soon. The “permanent peak season” that characterizes current demand, Baker said, “could get crazy” in August and September when holiday orders typically surge. The South China Morning Post, an English-language newspaper in Hong Kong, describes the congestion as “severe” and has reported that the current slowdown is the worst since 2019. Unfortunately, the challenges don’t end there.

Load Types and Freight Costs

For importers of manufactured goods, load sizes and freight costs are also concerns. Less than container loads (LCLs), freight shipments that do not consume the full capacity of a shipping container, require the consolidation of multiple loads. That’s not especially attractive to shippers who have plenty of full container loads (FCLs) that they can pick up in China already. Because limited space for LCLs is available, importers can expect to pay higher prices because of the mismatch between supply and demand.

Clearly, what began in January as a global shipping container crisis has clearly morphed into another supply chain challenge in July. In order to get the products that they need, especially in lower volumes, North American and European manufacturers need to consider alternatives to long supply chains. The holiday season may seem distant, but manufacturers in the West are already competing for cargo space with retailers. By planning now to avoid future supply chain dislocations, companies can reduce risks and costs long-term.

How to Shorten Long Supply Chains for Rubber and Plastic Parts

Reshoring is increasingly popular, but there are some manufactured goods that are tough to source domestically. There are also products that are cost-effective to offshore when your order quantities are high. For example, if you need high volumes of molded rubber and molded plastic products, an offshore option could make sense. However, working with an offshore supplier can be challenging for many of the same reasons, such as total cost of ownership, that are driving reshoring in the first place.

The bottom line, however, is that saving a few pennies on a part won’t do you any good if you can’t get that part in the first place. In order to avoid stockouts, smart manufacturers are choosing a procurement solution that doesn’t tie up cash or warehouse space. These companies are issuing blanket purchase orders to Elasto Proxy for higher quantities and letting us store these items (raw materials or finished goods) in our North American and European warehouses. Our customers then issue releases and pay for parts when we ship them.

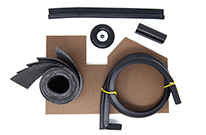

Do you need industrial rubber and plastic products such as finished gaskets, thermal and acoustic insulation, or molded parts? Would you like an alternative to the uncertainty that surrounds long supply chains? Ask Elasto Proxy how you can leverage value-added services and shorten your supply chain with us.