The supply chain crisis is so big that you can see it from outer space. Late last month, satellite images revealed an armada of idle cargo ships that are waiting to dock at the Port of Long Beach in California, USA. Long Beach is hardly the only port with this problem, and “Containergeddon” is only part of what’s causing the global supply chain crisis. In addition to shipping problems, there are bottlenecks in production and receiving that share some of the blame.

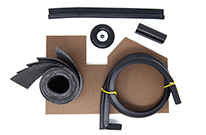

Elasto Proxy, a global distributor and fabricator of industrial rubber products, is following the supply chain crisis closely and working closely with customers to find solutions. At a time when it’s hard to predict what will be out-of-stock next, we have the ability to order and store everything you’ll need for 2022 and beyond. You won’t have to pay for rubber products until we ship them to you, and you’ll improve production efficiencies while reducing the risks of shipping and receiving delays.

Production

The causes of the supply chain crisis are inter-related, but stockouts are good to place to start. Whether it’s raw materials or finished products, vendors can’t send you what they can’t source. Take rubber gaskets as an example. If you buy rubber coils and cut them in-house, you might be getting them from a distributor who buys even larger rolls and cuts them to size. With pre-cut lengths or finished gaskets, a fabricator still needs to buy larger coils and keep these materials in stock.

Today, some (but certainly not all) rubber products come from Asia. If they come from China, it’s not just the pandemic that’s hurt production. Because of government orders to curb electricity usage, there are rolling power outages that are limiting industrial output. Vietnam is now a lower-cost alternative to China, but COVID outbreaks have closed factories there. Even if material production in North America and Europe continues to ramp up, there are still key ingredients that come from Asia.

Yet there would still be production problems even if all of the materials you needed magically appeared. Today, companies in all industries are striving to meet pent-up demand that’s now broken loose. Adding a second or even a third shift can increase a manufacturer’s production capacity, but companies can’t seem to hire faster workers fast enough or find employees who have the right skills. Again, consider the example of gasket fabrication.

If you cut rubber gaskets in-house with hand tools, the last thing you want to do during a labor shortage is to deploy highly-skilled employees (such as welders) on tasks like this. You can outsource your gasket fabrication instead, and you’ll improve efficiency if you choose water jet cutting. Still, even this semi-automated process requires labor. There are CAD drawings to review, machines to load with sheets or extrusions, and cut lengths or finished gaskets to bond, box, and ship.

If a fabricator can hire enough workers, it may still be a challenge to deploy them properly since a sudden stockout can leave employees idle. There are also limits to how much rubber a machine can cut in a unit of time. At Elasto Proxy, we’ve recently added a second water jet cutter and have hired additional staff. Yet, these are just two legs of a three-legged production stool. At a time when stockouts are common, we’re asking our customers to share their sales forecasts so that we’ll have everything that they need.

Shipping

With today’s supply chain crisis, short-term thinking can prove costly. In China, home to some of the world’s busiest ports, expectations that the pandemic there had ended were upset by COVID outbreaks that caused port closures. Typhoons have also created shipping snags. Across the globe, bulk carrier vessels blocked traffic in Egypt’s Suez Canal first in March 2021 and then again in September. In a global economy, even local or regional problems can have far-reaching consequences.

Skyrocketing freight rates have also complicated global trade. According to the Oxford Economics / Freights Baltic Index, and as reported in Yahoo News, the average cost of shipping a container from China to the U.S. East Coast has soared 194% since May 2021. Container shipments from China to the U.S. West Coast are even more expensive with an average increase of 210%. Meanwhile, shipping a parcel from Shanghai to Los Angeles is six times more expensive than shipping one from Los Angeles to Shanghai.

Part of what’s driving this disparity, and a major factor in the supply chain crisis overall, is a shortage of containers and the problem of having containers in the wrong place. During the height of the pandemic, many companies that forecast a need for new containers canceled their orders. Meanwhile, China recovered from COVID first because the pandemic started there. Chinese manufacturers then shipped full containers to Europe and North America, but companies on those continents had halted production.

As empty containers sat at ports waiting to be refilled and returned, some in the air freight industry saw an opportunity to return them more rapidly. Because of subsequent congestion and cost, however, these hopes have grown dim. “October is probably going to be one of the worst month (ever) in terms of airfreight transportation for the shipping community,” said Edward DeMartini, vice president of air logistics development for North America at Kuehne + Nagel, the world’s largest air forwarder in terms of volume. As fuel prices continue to rise, hikes in avgas costs can’t be far behind.

Receiving

Some of the congestion that DeMartini describes is by land, but many shipments also travel at sea. On the West Coast of the United States, there were 61 container ships anchored and 25 at berth between Los Angeles and Long Beach as of October 11th. That’s not a small problem given that L.A. and Long Beach are North America’s first and second largest ports, respectively. There are also delays in receiving shipments on the West Coast at Port Metro Vancouver in Canada, and on the U.S. East Coast as well.

Unlike in Europe, most U.S. ports don’t operate on 24/7 basis. Fortunately, the Ports of Los Angeles and Long Beach have both recently announced that they will operate on an extended basis. As Derek Thompson of The Atlantic wrote before the news broke, “Decades from now, we might look at the legacy of the pandemic, and see that it took a global crisis of choke points to teach us that real progress begins by removing the choke points at home,” an observation that applies to many countries.

Until the ships at sea can be unloaded, however, there aren’t enough empty container to send back to Europe or Asia so that they can be refilled. Even then, products need to travel across the North American continent to their destinations. In Canada, a shortage of railroad workers is slowing shipments even as the U.S. plans to reopen land borders with its neighbors both to the north and to the south. Meanwhile, the Minnesota Trucking Association estimates that the U.S. has a shortage of about 60,000 drivers.

Solving Your Supply Chain Crisis

The problems that are affecting receiving, shipping, and production are complex and inter-related, and the solution is neither simple nor quick. As Peter Sand, chief shipping analyst at Copenhagen-based BIMCO, a shipping trade group, recently said, “We expect…strained supply chains to last until the early parts of 2023.” At a time when consumers are increasingly worried about what will be available for the holidays, industrial buyers have plenty of headaches of their own.

As a fabricator and distributor of industrial rubber products, Elasto Proxy can’t cure what’s ailing global supply chains. However, we can ease some of the pain that you’ve been feeling. If you can forecast what you need for 2022, consider issuing us a blanket purchase order now. We can order all of the rubber products that you’ll need and store them in our North American and European warehouses. We won’t invoice you until we ship, and you can buy fabricated products as well as distribution items.